So, the shareholder’s equity of the company is $64,000. Shareholder’s Equity = Total Assets -Total Liabilities Firms with a return on equity of 20 percent or above are considered good investments opportunity.Įxamples of Return on Equity Formula (With Excel Template) Equity analysts or investors feel if a firm’s return on equity is less than 13-14 percent, it is not a good firm to invest in.It reflects that the company’s management is not in a state to provide investors with substantial returns on their investments.A firm with a low Return on equity means that the firm has not used the amount invested by shareholders efficiently.So it is the investor’s choice to make an investment into the particular sector to get benefitted.Moreover, the return on equity is different for different sectors the textile sector will have a different return on equity than the information technology sector.

#Return on equity formula how to

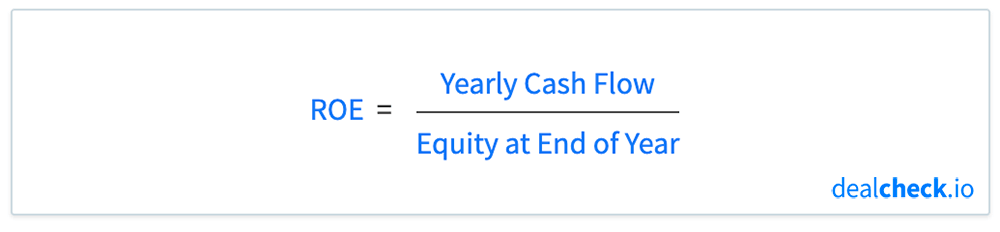

A firm with sustainable and growing ROE over time indicates that it can generate shareholder value because it understands how to reinvest its earnings sensibly to boost productivity and profits.Shareholder fund comprises reserves the company generated from its operation in the past. Shareholder’s equity is also called shareholder’s fund. Whereas shareholders’ equity is calculated from a company’s balance sheet. In the Return on Equity formula, net income is taken from the company’s income statement, which is the total sum of financial activities for that particular period. Shareholder’s Equity is the ownership of assets each shareholder claims after deducing total liabilities from total assets.Net Income is the total profit generated by a company in a given financial year.

Return on Equity = Net Income/Shareholder’s Equity

0 kommentar(er)

0 kommentar(er)